Technology platform overview

Investors must see the scalable SaaS infrastructure behind the business.

Include:

- Platform architecture overview

- How it enables loan origination, monitoring, risk management

- Reporting capabilities & compliance

- Key KPIs (originations per month, asset management visibility, etc.)

- Product demo video (if available)

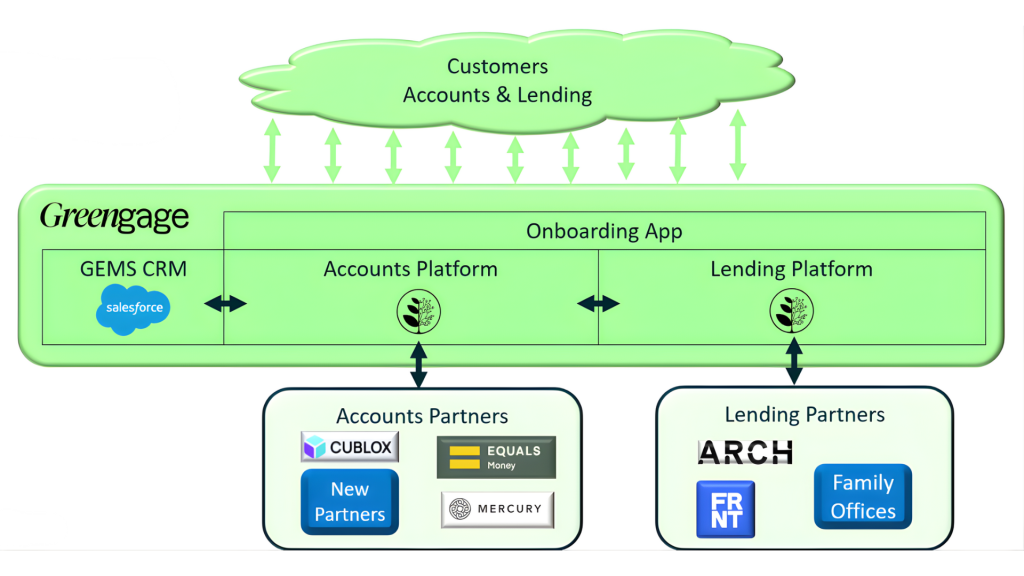

Platform Architechture Overview

Greengage’s technology platform is built for scalability, security, and compliance. At its core is GEMS CRM, integrated with an advanced onboarding application and dedicated accounts and lending modules. This architecture connects customers to a curated network of account and credit partners through a secure, moderated environment. By leveraging open finance principles, the platform enables seamless access to traditional and digital financial services while maintaining institutional-grade standards.

Greengage’s platform architecture integrates GEMS CRM with an onboarding app, accounts module,

and lending module, connecting clients to trusted partners for secure, scalable financial services.

Functional Capabilities

Our platform delivers a wide range of capabilities designed to support businesses in managing accounts, lending, and treasury solutions.

Key features include:

- – Multi-partner account access via Banking-as-a-Service (BaaS) integrations.

- – Credit solutions sourced from diverse providers, including structured credit, tokenised real-world assets, and DeFi strategies.

- – Treasury management tools that enable sourcing and allocation of yield-generating opportunities across five core pillars: RWA Tokenisation, Structured Credit, Blue-chip DeFi, TradFi Treasury Management, and BTC Lenders. This functionality ensures flexibility, diversification, and efficiency for SMEs, crypto firms, and high-net-worth individuals.

Loan Origination

Greengage’s platform enables secure and compliant loan origination by connecting clients to multiple credit providers, including structured credit, tokenised real-world assets, and DeFi strategies. Each opportunity is sourced and allocated through a moderated environment to ensure transparency and efficiency.

Monitoring

All active loans and credit positions are continuously monitored across seven risk dimensions—such as counterparty, security/cyber, liquidity, and ESG factors. Enhanced monitoring is applied where additional conditions are required, ensuring institutional-grade oversight.

Risk Management

Risk management is embedded into every stage of the process. Opportunities are evaluated for yield, liquidity, and risk score before approval, with quantitative stress testing applied to assess potential losses. This multi-layered approach ensures compliance and mitigates exposure to market and structural risks.

Reporting & Compliance

Security and compliance are embedded into every layer of the platform. Each opportunity and transaction is assessed across seven dimensions: counterparty, security/cyber, asset pool, structural, market and macro, ESG/reputational risk, and quantitative analysis of expected and stress losses. This rigorous process ensures institutional-grade security, regulatory compliance, and enhanced monitoring where required—giving clients confidence in every interaction.

Key KPIs

Our platform is designed to deliver measurable outcomes. Indicative metrics include:

- Gross Yield: Approximately 15% across diversified credit strategies.

- Liquidity: Typically under 90 days for selected opportunities.

- Diversification: Medium, with exposure across multiple asset classes and strategies. Through careful risk management and strategic allocation, Greengage targets c.8% net APY while maintaining strict compliance and security standards.